Over the past two weeks, I conducted what I thought was a simple experiment:

I used a small amount of money to buy a real U.S. stock portfolio.

The amount was tiny, but the emotional journey was unexpectedly intense.

This experiment, which started from stock picking, to building a mini-portfolio, to adjusting positions, to riding through nightly price swings, gave me a full, unfiltered experience of what retail investors actually go through.

And I learnt and internalised through this experiment what a retail investor truly need from a trusted financial consultant when it comes to long-term investing. I would like to share my first-person account of the experiment in this article.

Important Note: My personal experimental mini portfolio was set-up based on my own rationale and inclination towards specific characteristics of the businesses of interest to me, and for the purpose of experiment only. This experimental portfolio I shared below is purely to demonstrate my actual thought processes throughout the experiment. It is NOT a recommendation of stocks at all, and I do not encourage stock-picking nor offer any stock-picking service.

🌱 1. From Stock Selection to Portfolio Design: Perfect in Theory, Chaotic in Emotion

I dutifully studied investment theories and researched on stocks and companies. I learnt to read candle-stick charts and Bollinger Bands. I deliberately built the portfolio the way a typical retail investor would:

Stability picks: Coca-Cola, McDonald’s

My rationale → “At least these won’t crash overnight.”

Value & steady growth: Berkshire Hathaway, KKR, Apple.

→ “Steady cashflows, diversified. Feels safer.”

Tech growth: Alphabet

→ “Reasonable valuation, meaningful upside, understandable business models. Bought by Berkshire too.”

High volatility, high emotion and potentially high growth? Tesla

→ “For the full emotional experience of a revolutionary and futuristic outlook, well-controlled spending and production costs.”

I added two ETFs for diversification into non-US and emerging markets, hoping they could somewhat “neutralise” the exposure to AI-risk and US-centric large-cap.

On paper, this seemed to be a beautiful, well-diversified mini-portfolio to me.

But real-life? Not even close.

🌙 2. The Shocking Truman Show: I Became a Typical Retail Investor Overnight

For three nights in a row (16-18 Nov 2025):

I slept at 9 p.m Singapore Time. Woke up before 11 p.m. to check the U.S. market. Stock prices started falling.

I researched what could have caused it. Contemplated a contingency plan. Went back to sleep.

Woke up again at 3 a.m. Checked prices. Further research, further planning.

Checked the prices first thing in the morning at 5 a.m just after market had closed.

Every red candle made my heart drop. Every green candle made me wonder whether to add more.

The irrational in-and-out operations kicked in. Confusion, FOMO and mental exhaustion from decision-making overloads continued through to 18 Nov. And the stock prices continued to fall.

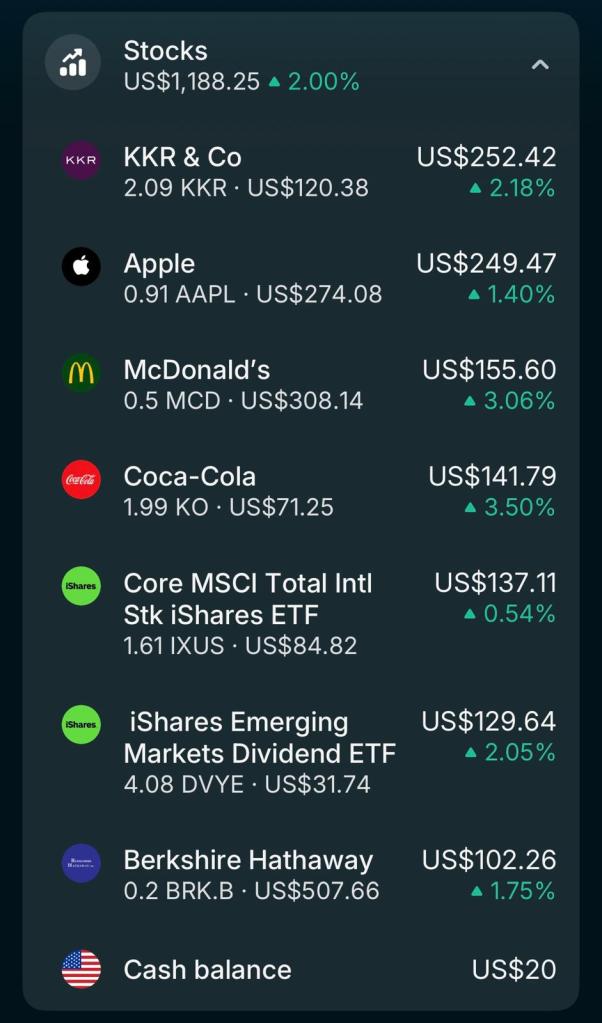

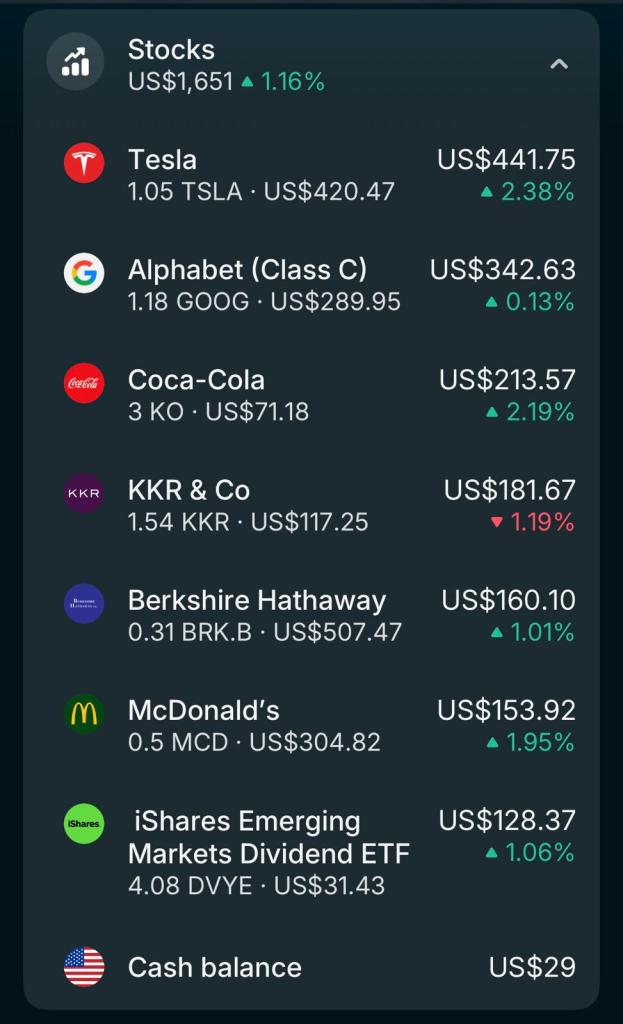

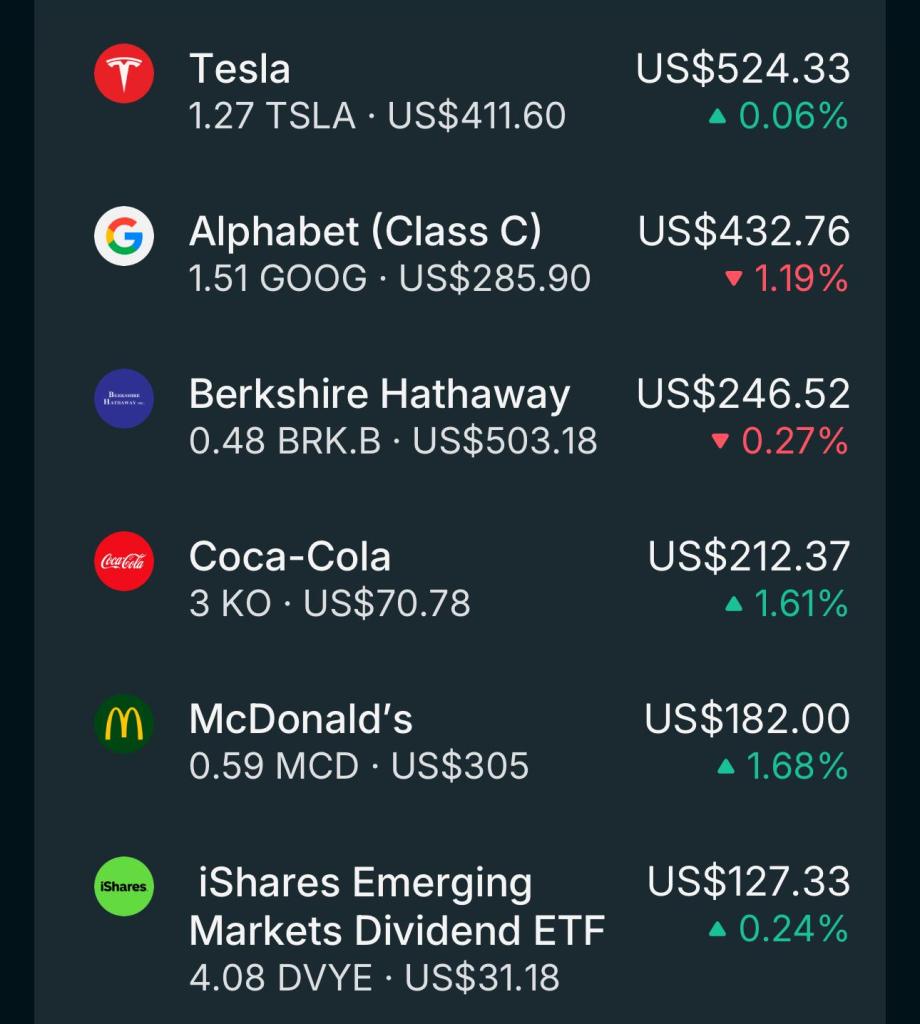

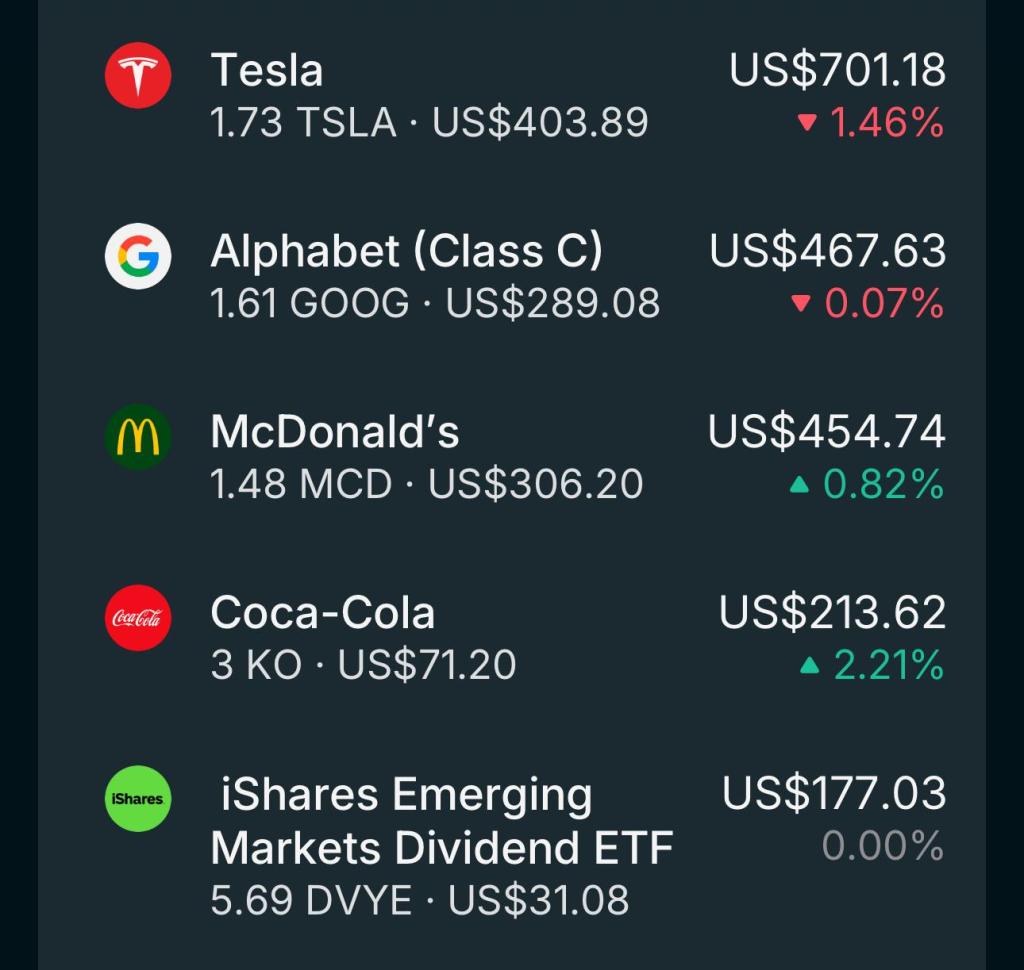

Notice how much the portfolio had changed from the initial set up over the 3 days.

I thought stock holdings of such small amounts wouldn’t affect me. But the truth hit hard:

Emotions don’t care about the amount. They react to uncertainty.

🔍 3. ETFs Couldn’t Save Me: Faraway Water Hose not helpful to Front-door Flames

I always assumed ETFs calm a portfolio; there were plenty of YouTube videos singing praises of ETFs. But when Tesla suddenly dropped $20, when Alphabet flipped red-green-red, ETF exposure did not make me feel any safer.

ETFs stabilize long-term performance, but they do not reduce short-term anxiety.

A retail investor’s fear happens now, ETF stability happens later.

That’s when I finally understood:

ETF = long-term tranquilizer

But retail anxiety = short-term fire

→ A faraway water hose can’t put out front-door flames.

🤖 4. Even With AI To Analyse in Real Time, My Anxiety Didn’t Go Away

I used AI (yes, my faithful chatGPT assistant whom I named “XiaoTian”) to help me to:

✔ Identify support arguments /resistance

✔ Understand market sentiment

✔ Analyse fundamentals

✔ Offer rational explanations

✔ Talk me out of FOMO

Yet…

I still checked stock prices.

Still worried about cash flow.

Still couldn’t sleep properly.

Because:

Information can’t cure emotions. Only a sense of safety can soothe the emotions.

A sense of safety is rooted on:

- Having enough cash buffer

- Not being forced to sell stocks

- Position sizing within tolerance

- Having backup plans

- Having a thinking partner

- Having someone who can read and empathise with our emotional reactions

This experiment taught me something important:

Retail investors don’t lack knowledge, they lack an emotional anchor.

🧠 5. I Finally Understand Why DIY Investing Is Exhausting

If you invest alone, you are simultaneously wearing all these hats:

- Analyst

- Trader

- Psychologist

- Cashflow manager

- Risk controller

- Long-term strategist

No wonder retail investors feel overwhelmed.

⚔️ 6. A duet fights better than a lone ranger: The role of a Financial Consultant

Financial consultants cannot “predict better.” They also do not try to “beat the market” with stock-picking or time transactions.

But the partnership with a financial consultant provides what no chart can offer:

1. Emotional stability

Someone to counterbalance your panic or impulsiveness.

2. Long-term strategy you can stick to

Not changing the game plan every time the market twitches.

3. A thinking partner

Someone to discuss, evaluate, and filter noise with.

4. A person who understands your life stage

Not just knowing your stocks, but one who knows you.

5. A psychological anchor

Over time, the investor who wins is not the one who guesses right, but the one who stays calm enough to stay invested. Time in the market beats timing the market.

🌈 7. Final Reflection: The Goal of Investing Is Not Excitement — It is Peace

This tiny experiment made me understand something deeply:

Good investing should feel like breathing, not like gambling.

It should let you sleep better, not waking you up at 3 a.m.

True wealth is not the biggest return, it’s having a calm mind and a stable life.

And readers, if your portfolio causes panic, insomnia, or constant checking, that’s not discipline; that’s a sign that you need:

- better cashflow management and a steadier long-term strategy

- someone to regulate your emotional volatility

- a trusted partner who understands both your money and your mind

Investing is not just numbers. It’s a human journey.

Disclaimer: Any article published on this website concerning personal finance are meant to offer views, tools and concepts in developing a healthy perspective and relationship with money. They are not financial advice and are not meant to replace personal financial advisory. Just as what the American financial advisor Tim Maurer said,”Personal finance is more personal than it is finance.”

Check out my LinkedIn Profile if you like and message me should you need any personal financial coaching or advice.

Leave a comment